Project name

| Type | Photography |

| Client | Marlboro |

| Year | 2014 |

Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. Ut wisi enim ad minim veniam, quis nostrud exerci tation ullamcorper suscipit lobortis nisl ut aliquip ex ea commodo consequat.

Get in Touch

Nonprofit Housing

As a nonprofit houser, we know what makes you tick. Our team has been working in this space for almost 30 years and our depth of experience allows us to bring risk management and insurance protection services which provide real, tangible value to you and your housing partners.

Nonprofit Service Providers

As a nonprofit service provider, we know what drives you. Our team has been working in this space for almost 30 years and our depth of experience allows us to bring risk management and insurance protection services which provide real, tangible value to you and those you serve.

Employee Benefits

Arroyo takes a consultative and service rich approach to designing employer sponsored benefits programs. We listen to you and then unleash our creativity team on the market to achieve the best solutions and pricing available. But that’s not where it ends, we provide you with your own benefits team to be at your service year round.

Personal Insurance

Arroyo maintains a full-service personal lines Department, insuring everything you can live in, drive, fly, sail, and even those valuables you wear, hang on the wall or store in the safe. Our personal lines team would be happy to offer a free evaluation of your current, home, auto or other personal insurance protection. We also have a private client practice for high-value estates.

Your Vehicles

Insuring business vehicles requires special care. When those vehicles are central to your business model, insuring them requires VERY special care. Business vehicles are a big part of the potential risk exposure of a business. Arroyo’s business vehicle specialists know how to integrate your coverage into a comprehensive plan that fits your unique needs.

Talk to one of our team members about your vehicles and your business.

Business Insurance

Arroyo offers a full-service VIP business insurance Department. Doesn’t matter what you own, buy, sell, build or create, our VIP team is specialty trained in all of these disciplines and can tailor the right protection for you while negotiating the best pricing with insurance companies. Since we work for you, you can know for certain we are providing you with the best every time.

Risk Services

In a day when most companies are asking you to pay more for less, Arroyo continues to expand its risk services practice for the benefit of our customers. Talk to us about our risk management best practices and how you can profit from these services.

Construction Risk

Arroyo's construction risk insurance specialists are available as an extension of your development team for all phases of your project. With 30 years of experience, Arroyo brings both technical expertise and market place relationships for all of your construction risk insurance needs, such as Builders’ Risk, OCIP (Wrap) programs and contract surety. Arroyo provides construction risk management services to our construction clients at our cost, now that’s value!

Property and Liability Insurance

Property and liability insurance coverages make up the core of your insurance program. With these coverages we insure the property entrusted to your care and insure you against the good work that you do. We also provide our exclusive risk services to our nonprofit partners at our expense.

Master Policy Program

The master policy placement concept is an important tool in managing your operational risk. This insurance policy design was originally designed and introduced to the nonprofit space by Arroyo and we still maintain a leadership role for this insurance product design in today's market. These coverage programs require great technical expertise and great care, Arroyo brings both to your table.

Contract Review

Risk for you and your partners is either increased or lessened by the agreements you sign every day. As your risk management department, we help you manage this risk by controlling how this risk flows within your agreements. Our skill in this area has been honed over decades and is unique to Arroyo; no other broker offers our depth of service in this area and without cost to you.

Management Liability

Management liability most commonly includes insurance protection such as Directors and Officers liability, Employment Practices Liability and Fiduciary Liability. The risk which arises from these areas of management operations can easily sync an organization if not properly crafted. Arroyo maintains the depth of knowledge necessary to tailor protection for your volunteer board, as well as paid staff.

Workers’ Compensation

If you have employees, as defined by the Labor Code, this insurance protection is mandatory for you. Premiums for this coverage are not always favorable and navigating technical aspects such as an experience modification can be daunting. As well, when a claim does happen you want an experienced professional by your side to guide you through the maze of rules and regulations, which make up this mandatory system. Arroyo maintains professionals dedicated to doing just that, looking out for you and your injured employee.

Loss Control

The day of just purchasing an insurance policy as "set it and forget it" is gone. Our focus at Arroyo is to help you avoid the claim in the first place. The easiest claim to adjust is the claim you were able to avoid. Our exclusive loss control services are provided for our nonprofit clients at our cost and include on-site services, vendor controls and contract risk review. No other broker in this space can offer this death of service, as offered by Arroyo.

Property and Liability Insurance

Property and liability insurance coverages make up the core of your insurance program. With these coverages we insure the property entrusted to your care and insure you against the good work that you do. We also provide our exclusive risk services to our nonprofit partners at our expense.

Property and Liability Insurance

Property and liability insurance coverages make up the core of your insurance program. With these coverages we insure the property entrusted to your care and insure you against the good work that you do. We also provide our exclusive risk services to our nonprofit partners at our expense.

Master Policy Program

The master policy placement concept is an important tool in managing your operational risk. This insurance policy design was originally designed and introduced to the nonprofit space by Arroyo and we still maintain a leadership role for this insurance product design in today's market. These coverage programs require great technical expertise and great care, Arroyo brings both to your table.

Management Liability

Management liability most commonly includes insurance protection such as Directors and Officers liability, Employment Practices Liability and Fiduciary Liability. The risk which arises from these areas of management operations can easily sync an organization if not properly crafted. Arroyo maintains the depth of knowledge necessary to tailor protection for your volunteer board, as well as paid staff.

Workers’ Compensation

If you have employees, as defined by the Labor Code, this insurance protection is mandatory for you. Premiums for this coverage are not always favorable and navigating technical aspects such as an experience modification can be daunting. As well, when a claim does happen you want an experienced professional by your side to guide you through the maze of rules and regulations, which make up this mandatory system. Arroyo maintains professionals dedicated to doing just that, looking out for you and your injured employee.

Loss Control

The day of just purchasing an insurance policy as "set it and forget it" is gone. Our focus at Arroyo is to help you avoid the claim in the first place. The easiest claim to adjust is the claim you were able to avoid. Our exclusive loss control services are provided for our nonprofit clients at our cost and include on-site services, vendor controls and contract risk review. No other broker in this space can offer this death of service, as offered by Arroyo.

Employee Benefits

You certainly hope your team will never need these coverages. However, the financial security an employee perceives with these ancillary benefits easily pays an employer back in productivity. As your team members have one less thing to worry about, they have more available energy to focus on work productivity.

Life and Disability Insurance

You certainly hope your team will never need these coverages. However, the financial security an employee perceives with these ancillary benefits easily pays an employer back in productivity. As your team members have one less thing to worry about, they have more available energy to focus on work productivity.

Voluntary Benefits

Current trends in employee preferences reveal your team members will value access to ancillary benefits on a voluntary basis. This is a way to bring a feeling of security and value your employee population without any cost to the employer. People like choices and providing voluntary benefits at a group discounted rate offers just this. Voluntary benefits will provide your team members value and make your benefits offering more robust without impacting your bottom line.

Pensions

Retirement plans such as 401k and 403b are becoming a more critical and strategic tool in attracting and retaining the talent which fuels your business success. Let us introduce you to an Arroyo pension specialist who can walk you through affordable plans and keep you compliant with constantly changing legal requirements.

Compliance

As an employer, you have responsibilities; COBRA, public exchange notification, W-2 reporting, community rating rules, summary plan description publication and the list goes on. Arroyo remains on the leading edge of compliance requirements and our depth here will help keep you out trouble.

Wellness

Why should an employer be concerned with the wellness of their employee population? A healthier team member is a more productive team member which translates value to a company’s or organization’s bottom line. As well, if you employ more than 50 employees, next year's premium will include a surcharge or a discount based upon the health of your employee population. Higher medical bills for your employees can mean higher premiums for you. We would be glad to discuss wellness efforts with you.

Your Home

Your house, condo or apartment is an important part of your life. If you suddenly find yourself without it, life changes drastically and you could find yourself bankrupt. Home insurance is intended to keep this from happening. This protection is more affordable than you might think, but does require an educated eye to tailor the right coverages to you and your lifestyle. At Arroyo, we are very good at this and would be glad to help you.

Private Client

Arroyo’s private client account executives understand the different needs and unique risks associated with the high-value marketplace. The high-value home is going to contain custom finishes, imported components and artisan designed features. Only the correctly designed insurance treatment can properly respond to these needs. We maintain great relationships with all of the top underwriters which know how to insure your home, your collections and other assets.

Your Cars

Your cars may be one of your largest investments, next to your home. Every insurance company in the street claims to be "the best." However, Arroyo account executives can see through all the hype and can guide you to the best coverage at the best price. Don't fall for an insurance company's catchy gimmicks or cartoon reptiles, we are real people and we know how to help real people.

Your Collections

you may have spent a lifetime collecting stamps, art, antiques or even fine wines. These special collections need special treatment and you will be surprised at how inexpensive it is to insure your investment in such collections. If you think it's valuable, tell us about it and let us show you the best way to protect it.

Special Vehicles

Motorcycles, boats, jet skis, motor homes and trailers all create fun times for us. However, you also understand each comes with a special type of risk. We know how to protect these vehicles from loss due to damage as well as help protect you from the liability from using them.

Umbrella

There are times when the limits of liability on your home or car insurance is just not enough to protect your assets. An "Umbrella" policy is how you get higher limits of protection. This additional protection is surprisingly affordable and will provide greater peace of mind and financial security.

Life and Disability

The need for life insurance protection is not the "sexiest" conversation to have with your loved one. However, buying this important protection to benefit your loved one is a very "loving" thing to do. Stop and consider how you are leaving your loved one financially if something happened to you today. Life insurance can be very affordable and can give you financial peace of mind, especially if you have a long-term mortgage or a need to provide a future college education for your children.

Real Estate

Real estate owners, developers and property managers face special risks and have special insurance needs. To build a robust real estate insurance program requires special technical and insurance industry knowledge. We know how to negotiate and build such an insurance program to protect you and save you money. We also have enough clout within the underwriter community to negotiate the best for you.

Workers’ Compensation

If you have employees, as defined by the Labor Code, this insurance protection is mandatory for you. Premiums for this coverage are not always favorable and navigating technical aspects such as an experience modification can be daunting. As well, when a claim does happen you want an experienced professional by your side to guide you through the maze of rules and regulations, which make up this mandatory system. Arroyo maintains professionals dedicated to doing just that, looking out for you and your injured employee.

Manufacturing and Distribution

You make great things, you move great things around the world…or you do both. Each part of this process creates special risks and rewards. We can help you with the risk part. We maintain account executives with specialized knowledge in product manufacturing and distribution and we know how to insurer and manage your risk. We would be glad to give you a second opinion on your current insurance and risk profile, as we are confident we can improve your coverage, save you money or both.

Professional Offices

Medical professionals, Attorneys, CPAs, Engineers and other professionals perform great services for their clients. However, since no good deed goes unpunished, you need to protect your livelihood and your professional staff from allegations of professional mistakes. You can do what you do perfectly, but eventually the recipient of your service will disagree. Let us show you how to properly protect yourself and create more financial certainty so you can get back to doing what you do so well.

Construction Risk

Arroyo's construction risk insurance specialists are available as an extension of your team for all phases of your project. With 30 years of experience, Arroyo brings both technical expertise and market place relationships for all of your construction risk insurance needs, such as Builders’ Risk, OCIP (Wrap) programs and contract surety. Arroyo provides construction risk management services to our construction clients at our cost, now that’s value!

Site Inspection

Managing risk and controlling loss is more important today than ever. One claim or one accident can bring your productivity to a screeching halt. Our site survey inspections concentrate upon assessing and identifying your risks to help you better manage this exposure. Our years of experience in risk analysis can bring great value to any organization.

Risk Analysis

Managing risk and controlling loss is more important today than ever. One claim or one accident can bring your productivity to a screeching halt. Our risk analysis concentrates upon assessing and identifying your risks to help you better manage this exposure. Our years of experience in risk analysis can bring great value to any organization.

Protection Review

How do you know that insurance policy you paid money for provides a protection your promised? Arroyo's technical industry knowledge can be tasked to carefully examine your existing insurance protection and compare it to a carefully crafted analysis of your risk and create a report of any gaps or impairments in your insurance protection. You may choose to retain certain risk rather than ensure it, but you should know exactly what you're retaining. Don't let this be an unknown variable.

Contract Risk

If you have signed a contract or any form of agreement with a third-party, then you may have just accepted risk you didn't have before you sign on the dotted line. We help you manage this risk by controlling how this risk flows within your agreements. Our skill in this area has been honed over decades and is unique to Arroyo; no other broker offers our depth of service in this area. Talk to us about how this important service can be provided without cost to you.

Training

An Arroyo risk manager can be made available to provide loss control and risk management training for your team members. Maintaining a critical eye toward loss control on a daily basis can add real value to your operations. Talk to us about how this important service can be provided without cost to you.

Medical

Medical insurance typically makes up most of an employer's group benefits offering. In the wake of a very complicated healthcare reform effort, employers are often left concerned about their ability to provide their team quality insurance protection. Tailoring an employee benefits program to your needs is as much art as it is science. Arroyo turns its creativity team loose on your program to design broad benefits and retain affordability.

Dental and Vision

Dental and vision insurance typically roundout the core offering of an employee benefits program. These employee benefits can be very affordable and can even be offered as voluntary offerings. Don’t get stuckoverpaying for an outdated program design or a narrow network of providers. Let ourcreativity team redesign and improve your dental and vision insurance offering.

Bruce C. Newsom, AAI President

P: (626) 792-7654

Bruce is a native of Pasadena and studied business and pre-law before transitioning into insurance and risk management in 1984. Strong technical knowledge in the industry is Bruce’s passion, and over his 30 years of hands-on experience, he has become a renowned expert in commercial insurance exposures and construction risk management. Early in his career Bruce began his work with non-profit developers of affordable housing and established himself as a leader in insurance and risk management for these organizations. He has put his extensive knowledge of contracts to work for his non-profit clients in an effort to provide significant value in risk management and risk transfer. Bruce also lectures on topics of insurance and construction risk, most recently for Housing California, the Southern California Association of Non-Profit Housing and USC’s Graduate School of Real Estate Development. He is also an accomplished craftsman and an avid skier. Bruce is an active volunteer for Union Rescue Mission in Los Angeles, the Pasadena Tournament of Roses, aBible study leader at his local Church and enjoys spending time with his family.

Robyn L. Grandy, JD, AAO, CRIS Senior Vice President

P: (626) 792-7654

Robyn relocated to California in 1999, and gained much of her insurance industry experience in the family business at a young age. She joined the firm in 2003 and her expertise in construction risk management and asset management serve as a strong foundation as account executive for many of Arroyo’s affordable housing clients. As a known technician in the field, Robyn has engineered master policy programs and overall risk analysis in our affordable housing division. She has lectured on risk management topics for the Southern California Association of Non-Profit Housing, San Diego Housing Federation and Housing California.Robyn also consults actively for Arroyo’s non-profit clients with social and human service operations, and she crafts protection programs to fit their unique needs. Her higher education includes a Bachelor of Music degree from California State University, LA and a Juris Doctor degree from Concord Law School. Robyn is a member of Insurance Professionals of Los Angeles and is also an active volunteer with the Pasadena Tournament of Roses, Mother’s Club Family Learning Center and is on the Board ofDirectors for the Junior League of Pasadena.

Cloud Based Technology

The day of paper enrollments has come to an end. Arroyo will provide our benefits clients with a customized and cobranded web portal to give employees a benefits shopping experience and our employers a robust benefits administration platform. We can make the benefits administration process simpler and faster AND take work off your desk. Yes, you read that right, we pay for this for you. It’s one way we invest in your success.

HR Resources

Have questions? We have answers. We provide our Benefits clients a personalized HR web resource for their use, 24/7. This is one of the most comprehensive HR databases in the HR world and we provide it at our cost. This is one way we invest in your success.

Auto Dealers

Not many operations possess the number of moving parts as dealerships do. This means you face greater risk than many other business operations. We maintain dealer specialists to identify your risks and we can deliver the broadest protection while negotiating the best pricing for you. Our program coverage and pricing is exclusive to Arroyo. We work for you and want to be your risk management department. Call us and let us show you the value we bring to you.

Craft Brewers

Brewers are unique as the beers they create. What you do is as much art as it is science. We understand you and know what makes you tick. We also have the relationships with underwriters which specialize in what you do. These market relationships, combined with our knowledge of the risks you face every day, allow us to deliver excellent protection at the most affordable rates.

Movie Boats

Being able to capture action on the water comes with unique risks. We know how to insure these risks and our underwriting partners aren't afraid of the amazing work you or your clients do. This underwritten program is exclusive to Arroyo Insurance Services. Call us and let's talk about what we can do to help you succeed

Nonprofit Housing Developers

Developing quality housing which is affordable is an art and requires a lot of hard work and imagination. You dream up new ways of helping people create home and community. The work you do brings risk to your organization, your Board of Directors and your constituents. Arroyo has three decades of experience managing risk, creating special programs and protecting all stakeholders within the Affordable Housing community. Our affordable housing program brings insurance coverage and pricing exclusive to or program and comes with loss control services provided at our cost. Our dedicated affordable housing team will come to you and show you the value we can bring to you and to your partnerships.

Bill Knauf

Bill grew up locally in Glendale. He studied business at USD and graduated in 1976 with a Bachelors in Business Administration. Coming from an insurance family, shortly after college Bill joined the family insurance agency in 1978. Bill initially was involved with personal insurance providing homeowners and auto insurance to Agency clients. While still being involved in a management position with personal lines insurance, Bill focuses on providing business insurance to his commercial clients. Bill focuses on small to medium size companies and has a breadth of knowledge that he can bring to the table for thesecustomers. Bill furthered his insurance education when he received his CPCU (Chartered Property and Casualty Underwriter) in 1991. In 1999, along with his partners, Bob Knauf and Bill Olhasso, Knauf Insurance Agency joined Arroyo Insurance Services. The decision to join Arroyo was a natural as Bill, Bob and Bill can continue to operate their branch, they gained the benefits of being involved with a regional broker. He has been involved in the local Insurance Association for years and was president in 1995. He is involved in Glendale Rotary and Pasadena Elks Lodge. He and Sherry, who he married the same year he entered the insurance business, raised three children locally.

Bill Olhasso

Bill has seen things.

Bruce Maxwell

Bruce Maxwell

Bruce C. Newsom, AAI President

Bruce is a native of Pasadena and studied business and pre-law before transitioning into insurance and risk management in 1984. Strong technical knowledge in the industry is Bruce’s passion, and over his 30 years of hands-on experience, he has become a renowned expert in commercial insurance exposures and construction risk management. Early in his career Bruce began his work with non-profit developers of affordable housing and established himself as a leader in insurance and risk management for these organizations. He has put his extensive knowledge of contracts to work for his non-profit clients in an effort to provide significant value in risk management and risk transfer. Bruce also lectures on topics of insurance and construction risk, most recently for Housing California, the Southern California Association of Non-Profit Housing and USC’s Graduate School of Real Estate Development. He is also an accomplished craftsman and an avid skier. Bruce is an active volunteer for Union Rescue Mission in Los Angeles, the Pasadena Tournament of Roses, aBible study leader at his local Church and enjoys spending time with his family.

Robyn L. Grandy, JD, AAO, CRIS Senior Vice President

Robyn relocated to California in 1999, and gained much of her insurance industry experience in the family business at a young age. She joined the firm in 2003 and her expertise in construction risk management and asset management serve as a strong foundation as account executive for many of Arroyo’s affordable housing clients. As a known technician in the field, Robyn has engineered master policy programs and overall risk analysis in our affordable housing division. She has lectured on risk management topics for the Southern California Association of Non-Profit Housing, San Diego Housing Federation and Housing California.Robyn also consults actively for Arroyo’s non-profit clients with social and human service operations, and she crafts protection programs to fit their unique needs. Her higher education includes a Bachelor of Music degree from California State University, LA and a Juris Doctor degree from Concord Law School. Robyn is a member of Insurance Professionals of Los Angeles and is also an active volunteer with the Pasadena Tournament of Roses, Mother’s Club Family Learning Center and is on the Board ofDirectors for the Junior League of Pasadena.

Casey Dodge

Casey Dodge is President of Dodge Insurance Services, Inc., located in Torrance, California, and became affiliated with Arroyo in 2006. He specializes in all types of business and commercial insurance including sales, marketing and service. Casey began his insurance career with The Travelers’s Insurance Company in 1967. In 1977, he became a founder and principal of Dodge, Warren & Peters Insurance Services, Inc. which was subsequently sold to a publicly held corporation. He graduated in 1967 from Cal State University Northridge with a Bachelor of Arts degree. He regularly attends industry related courses, seminars, worships and conferences on a multitude of insurance related topics. Casey was born and raised in Los Angeles, California, and is married with two children, one who is working with him. He is a member of several well respected clubs in Southern California, The Avalon Tuna Club, The King harbor Marlin Club and The Wilshire Country Club.

Christian Dodge

Graduated from Crespi Carmelite High School in 1997 Attended Santa Barbara City College 1997-1999 Graduated from General Motors ASEP program in 2003 Worked as a Heavy-Line Technician for Cadillac from 1999-2003 Worked as a Sales Executive in offset printing from 2003- 2006 Went back to college to finish Bachelor’s degree in Business Administration in 2007 Received Property & Casualty insurance license April 2009 Begin Working as a licensed producer for Arroyo Insurance Services, Inc. April 2009-present. Graduated May, 2009 CSUDH in Business Administration Attended The Hartford School of Insurance Commercial Lines Development Program June 2009- received CLCS Designation Received Life-Only Agent License Sept 2009 Attended Chubb Commercial Insurance Basics in Chicago November 2009 January 2010 wrote first Workers Compensation account with premium over $500,000 Attended Ethics course help by NAIW (national association for insurance women) March 2010 Attended CHILD SHARE fund raiser held by CAIP April 2010 Attended Zurich builder’s risk seminar May 2010 Corporate sponsor of Assistance League of Pomona Valley May 2010 Volunteering in Arthritis Walk June 2010 Participating in Rich Martin Memorial Golf Tournament June 2010, 2011, 2012, 2013 Attending SATTS II in Chicago with CNA Insurance June 2010 $500 Scholarship recipient for IBA West YBAC Conference June 2010 Joined Clean Tech OC September 2010- present as a sponsor, helping business learn more about Clean Technology and the benefits within their communities. Joined International Council of Shopping Centers May 2012- present Joined The Tuna Club of Santa Catalina Island in 2012-present, the oldest fishing club in the world, and the original birthplace of rod & reel fishing, founded in 1898. Hosted 4 Workers’ Compensation Seminars touching on Fraudulent claims, Experience Modifications, and the ABC’s of reserving classes from 2013-present Attended California Certified Authority On Workers Compensation courses May 2015

Rob Kelly

Bruce is a native of Pasadena and studied business and pre-law before transitioning into insurance and risk management in 1984. Strong technical knowledge in the industry is Bruce’s passion, and over his 30 years of hands-on experience, he has become a renowned expert in commercial insurance exposures and construction risk management. Early in his career Bruce began his work with non-profit developers of affordable housing and established himself as a leader in insurance and risk management for these organizations. He has put his extensive knowledge of contracts to work for his non-profit clients in an effort to provide significant value in risk management and risk transfer. Bruce also lectures on topics of insurance and construction risk, most recently for Housing California, the Southern California Association of Non-Profit Housing and USC’s Graduate School of Real Estate Development. He is also an accomplished craftsman and an avid skier. Bruce is an active volunteer for Union Rescue Mission in Los Angeles, the Pasadena Tournament of Roses, aBible study leader at his local Church and enjoys spending time with his family.

Craig Tom

Craig started his insurance career with Liberty Mutual Insurance Company in 1984, where he was a Business Sales Representitive and Resident Manager. In 1989, he joined James Econn and Co. From 1991 to 2005 he was a Producer and Partner at Dodge, Warren & Peters Insurance Services in Torrance. In 2005, Craig joined Arroyo and is currently the President of Craig Tom Insurance Services, Inc. in Arcadia. Craig services clients in the manufacturing, distribution/wholesale, restaurant, real estate and service industries. Craig graduated with a Bachelor or Science in Business Administration – Finance from California State University, Los Angeles in 1982. Craig is married, has three sons and resides in Arcadia.

Jeff Scott

I join Cedric Scott & Sons in 1981 after graduation from San Diego state University with a degree in Insurance. I had worked with both Farmers and Northwestern Mutual Life in an internship program will at SDSU. We joined Arroyo Insurance Services in 1996. During this time I have been very involved with the San Marino Chamber of Commerce. I was President for 2 years in 1991 and 1992. I am married to Jennifer for the past 30 years and living in Glendora for the past 18 years. We have 5 children Nick who is working with me. Megan is working as a speech SLP in the Charter Oak school district. Brad, Alina, and Christian all attend school in Glendora. I have been very involved in our community in youth sports and Boy Scouts. Over the past 18 years of Scouting I have held my leadership position in Cub Scouts, Boy Scouts, and Venture Crew. Nick got his Eagle Scout award, Megan got her Silver award from Girl Scout, Brad almost has his Eagle and Christian is on his way. My favorite things to do is going camping and backpacking. This is what the scouts have let me do with my kids. I also play tennis and golf as I can find time. Our family most enjoys visiting Lake Arrowhead. We all like being on the lake in the summer boating and doing other water sports. We find it very relaxing the other times of the year too. I look forward in meeting you in the future.

Jim Armitage, Sr. Principal

Jim has been in the Insurance business since 1981. He has specialized in Commercial Insurance Protection. Jim earned the Chartered Property and Casualty Underwriter designation, CPCU, in 1986. He heads the Strategic Planning Committee for Arroyo Insurance Services. He is the founding partner of Arroyo Insurance Services and its first president in 1986. Jim began his insurance career as a commercial underwriter and marketing representative with Aetna Casualty & Surety Company in 1978. He holds a Bachelor of Science Degree in Business Administration with a minor in Marketing and International Management from the University of Southern California.

Jim Simonds

Jim is one of the founding members of Arroyo Insurance Services since its inception in 1987. He began his career in San Francisco as an Underwriter Trainee with Crum Forster in 1975. Subsequent to that posting Jim worked for the Massachusetts Mutual Life Insurance Company as a Group Representative both in Los Angeles and San Francisco until 1982. Jim relocated to Southern California in 1983 to attend the Aetna Life and Casualty Agent school located in Hartford Connecticut. Jim worked with his father Albert C. Simonds in his agency until Jim purchased the business in 1992. Jim is well versed both in Employee Benefits and Property and Casualty. Jim has developed specific Risk Management services for Healthcare companies and has worked with a number of the new emerging Healthcare/ Bio Technology Companies both within and outside of California. This is a rapidly growing field and Jim along with his staff at Arroyo has developed the expertise to lend these specific Companies. In addition Jim has helped to develop an Insurance program for the rapidly expanding Vacation Rental Home Industry. Jim holds multiple Insurance designations, both the CIRS ( Construction Insurance Risk Specialist) and CHRS (Certified Healthcare Reform Specialist), along with a Bachelor’s degree. He serves as the Vice Chair of the Los Angeles Rotary Club Foundation and is an active Board Member of the Catalina Island Conservancy “Marineros”. Jim and his family reside in Glendale, California.

Nick Scott

Nick Scott joined Arroyo Insurance Services in 2008 and became a producer in 2012. He currently serves as a commercial lines broker specializing in crafting specialized insurance programs for manufactures, wholesalers, and distributors. Nick began his insurance career at the youthful age of 18, acting as a fully licensed customer service representative for personal lines clients. Upon completion of college, he transitioned into the commercial lines side of the business. His attention to detail and superior client service make him a valuable member of the Arroyo team. Prior to joining Arroyo Insurance Services as a commercial lines broker, Nick completed an extensive work-study program with FRESCA Medical as a market researcher. Nick and his team conducted extensive research on the medical device industry and constructed an industry wide report on compliance with CPAP (Continuous Positive Airway Pressure) devices among users. A native to the Los Angeles Area, Nick is an Eagle Scout and a recipient of the American Legion School Award. Nick is a member of the Pasadena Jaycees, where he serves as a 5 Acres committee member. Nick holds a Bachelor of Science degree in Business Administration from California State University San Marcos.

Jason Winzen

Bruce is a native of Pasadena and studied business and pre-law before transitioning into insurance and risk management in 1984. Strong technical knowledge in the industry is Bruce’s passion, and over his 30 years of hands-on experience, he has become a renowned expert in commercial insurance exposures and construction risk management. Early in his career Bruce began his work with non-profit developers of affordable housing and established himself as a leader in insurance and risk management for these organizations. He has put his extensive knowledge of contracts to work for his non-profit clients in an effort to provide significant value in risk management and risk transfer. Bruce also lectures on topics of insurance and construction risk, most recently for Housing California, the Southern California Association of Non-Profit Housing and USC’s Graduate School of Real Estate Development. He is also an accomplished craftsman and an avid skier. Bruce is an active volunteer for Union Rescue Mission in Los Angeles, the Pasadena Tournament of Roses, aBible study leader at his local Church and enjoys spending time with his family.

John Williams

Bruce is a native of Pasadena and studied business and pre-law before transitioning into insurance and risk management in 1984. Strong technical knowledge in the industry is Bruce’s passion, and over his 30 years of hands-on experience, he has become a renowned expert in commercial insurance exposures and construction risk management. Early in his career Bruce began his work with non-profit developers of affordable housing and established himself as a leader in insurance and risk management for these organizations. He has put his extensive knowledge of contracts to work for his non-profit clients in an effort to provide significant value in risk management and risk transfer. Bruce also lectures on topics of insurance and construction risk, most recently for Housing California, the Southern California Association of Non-Profit Housing and USC’s Graduate School of Real Estate Development. He is also an accomplished craftsman and an avid skier. Bruce is an active volunteer for Union Rescue Mission in Los Angeles, the Pasadena Tournament of Roses, aBible study leader at his local Church and enjoys spending time with his family.

Keith S. Moreland, CIC

Keith has been an Insurance Broker since 1988. He specialize Commercial Insurance for a variety of industries including Construction, Manufacturing, Wholesale and Service Industries. Keith has a BS in Finance from USC and a MBA from CSUSB. He earned his Certified Insurance Counselor designation in 1991. Keith has served on the producer councils for several Insurance carriers as well as the state boards of PIA and WIAA and is currently on the board of WIAA Insurance Services. Keith joined Arroyo Insurance Services in 2003. Keith is an active member and Past President of the Optimist Club of Redlands, member of the board of directors for the Boys & Girls Clubs of the Greater Redlands-Riverside.

Bruce C. Newsom, AAI President

Paulette entered the insurance business world while still in high school. The journey began working as a file clerk while attending college and grew into 30 years of serving her clients as an insurance professional. Her forte lies with consulting and managing the personal lines department and helps service commercial policies. Thriving on the interactions between clients and carriers is what she finds most rewarding. Paulette is very active in the community including being on her church board. She recently was given the Timothy Award by the Nazarene Youth International to recognize her sacrifice, commitment and service to youth for over 20 years. She enjoy spending time with her husband, family, dogs and outdoors.

Tom Higgins

Tom grew up in San Diego attending Torrey Pines High and San Diego State University. He began his insurance career in 1982 and is third generation insurance agent. At a young age he found being an insurance agent is about helping people. As he puts is “All you are doing is protecting them, their families, businesses and assets”. Known as a technician, he often reads policies, contracts, leases and other agreements. Believing in giving back to his community and industry, he has served on multiple boards including as treasurer for several non-profits for over 20 years, is active with several insurance organizations and has lectured at colleges about business and insurance. He has earned both the Certified Insurance Counselor and Certified Risk Manager designations. He enjoys classic cars, streetand dirt motorcycles, the outdoors and is an avid sports fan.

Pasadena Green St. Office Departments

- ALL

- BUSINESS INSURANCE

- PERSONAL INSURANCE

- EMPLOYEE BENEFITS

In the Community

A fantastic picture of our happy staff enjoying the recent Annual Taste of Boyle Heights and supporting East LA Community Corporation!

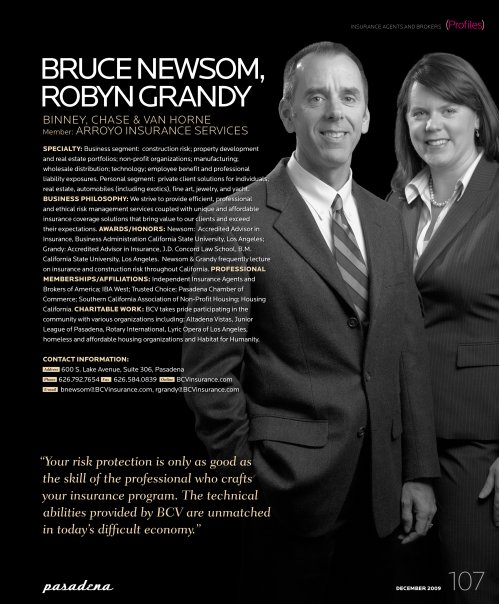

Arroyo in the Media

Arroyo in Pasadena City Magazine

Arroyo Insurance Services has been featured in Pasadena City Magazine for their large impact on the community in Pasadena. Arroyo has helped many communities in the Greater Los Angeles area.

We have volunteered with many organizations in the past such as the Junior League of Pasadena, Rotary International, homeless and affordable housing organizations, and Habitat for Humanity.